Estimated Tax Payments 2024 and How They Work

If you’re a small business owner, learn how and when to make an estimated tax payment in 2024.

What are estimated tax payments?

Estimated tax payments are taxes paid to the IRS throughout the year on earnings that are not subject to federal tax withholding. This can include self-employment or freelancer earnings or income you've earned on the side, such as dividends, realized capital gains, prizes and other nonwage earnings (read more at IRS.gov).

If you are in business for yourself, you generally need to make estimated tax payments. Estimated tax is used to pay not only income tax, but other taxes such as self-employment tax and alternative minimum tax.

If you don’t pay enough tax through withholding and estimated tax payments, you may have to pay a penalty. You also may have to pay a penalty if your estimated tax payments are late, even if you are due a refund when you file your tax return.

When are estimated taxes due?

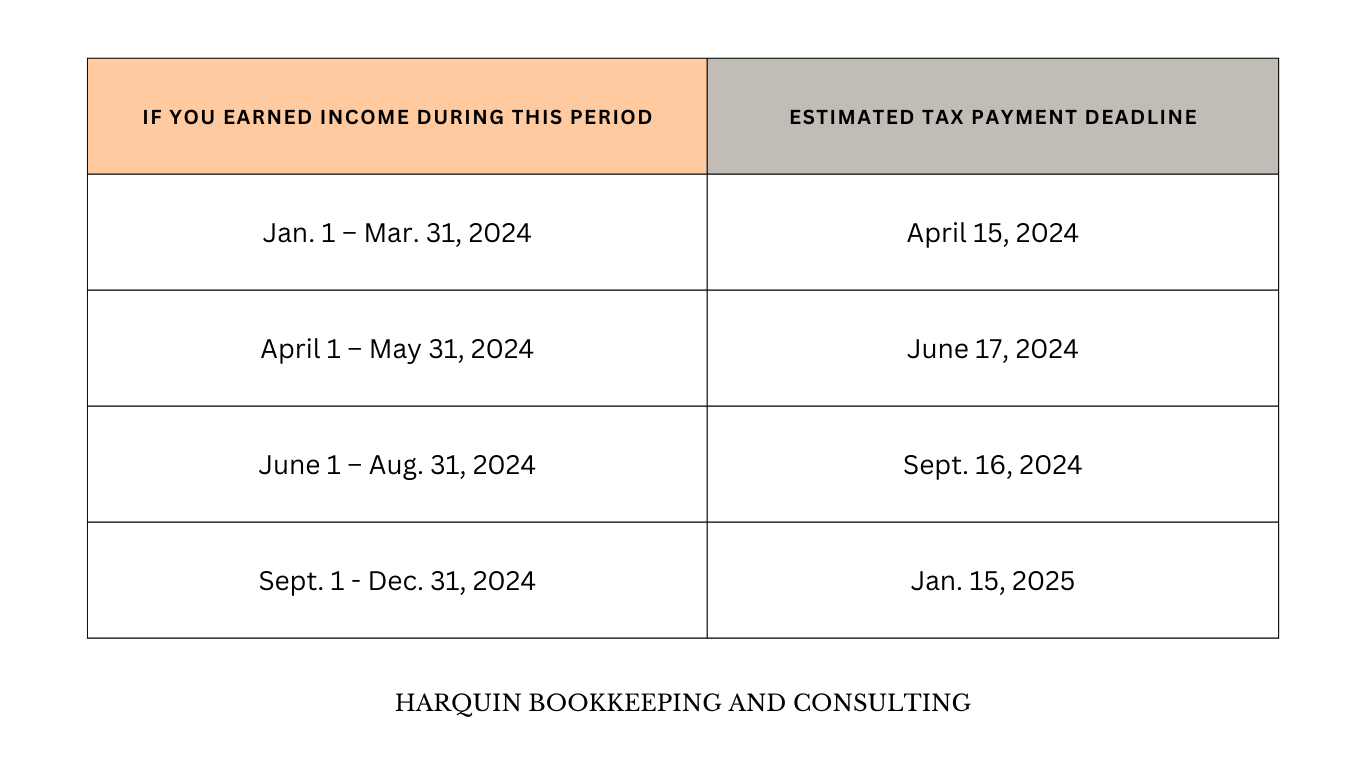

Estimated tax payments should be made as income is earned, with the IRS collecting them quarterly. These dates don’t coincide with regular calendar quarters, though. Instead, they are due in January, April, June, and September.

Estimated tax payments 2024

Who should make estimated quarterly tax payments?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed. These are 1099 workers, W-2 workers who are not withholding enough to cover their tax bill, businesses, and some investors.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals for more details on who must pay estimated tax.